GPT Models in the Banking Sector: Revolution in Artificial Intelligence

Building upon the insights shared in our previous article, Utilizing Artificial Intelligence Techniques in Constructing Intelligent Software Robots, in this installment we delve into GPT Models in the Banking Sector, providing insights into our solution: the EasyRPA Platform.

Let’s discuss generative models, the latest revolution in the field of artificial intelligence. Over the past year, we have witnessed remarkable progress in the realm of Generative Pre-trained Transformer (GPT) models. Trained on massive datasets, these models have the ability to generate text and process information at a level that was previously deemed unattainable.

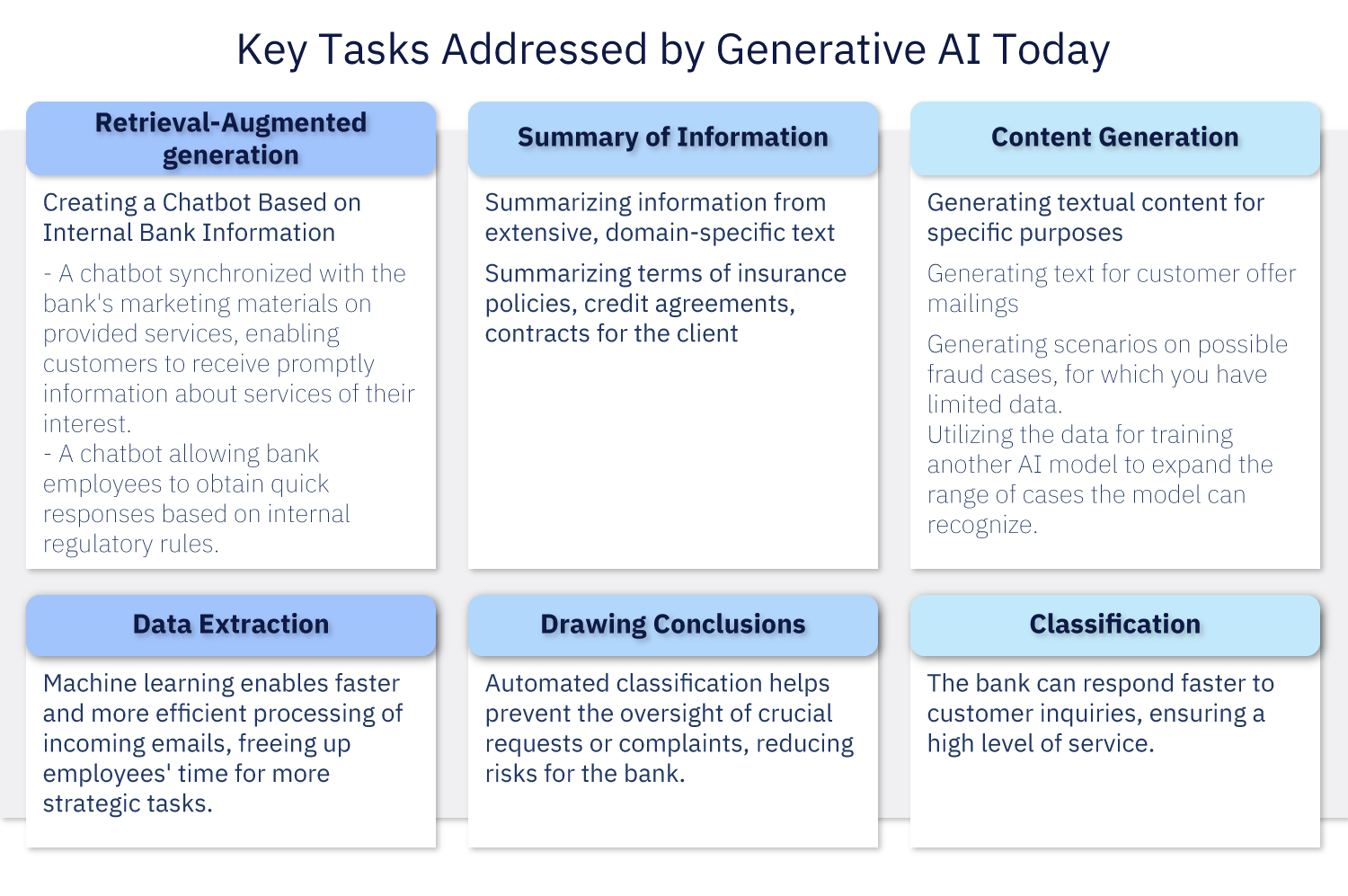

Generative Models in certain cases successfully handle tasks we’ve discussed earlier, such as classification, information extraction, and even show results that sometimes exceed those of specialized models. However, it’s worth noting that traditional models operate faster and require significantly fewer resources for their functioning. Accordingly, if a traditional model can handle a task, it is optimal to use it.

We would also like to focus separately on the fascinating area opened up by generative models, Retrieval Augmented Generation (RAG), where these models generate content with the assistance of a search mechanism.

Retrieval Augmented Generation (RAG)

These are specialized techniques that allow using pre-trained large language models, such as OpenAI, for efficient handling of data. The techniques help connect generative models with any data that contains text and interact with this information.

Banking Sector Example

In the banking sector, the RAG technique is employed for communication with documents that contain marketing materials. For instance, a banking chatbot synchronized with the bank’s marketing materials enables customers to obtain information on relevant services based on specific criteria. This eliminates the need for manual examination of materials.

Which tasks do we entrust to artificial intelligence?

The question of which tasks can one entrust to artificial intelligence becomes increasingly relevant in the context of automating bank business processes? The answer to this question is ambiguous and depends on the specific application area.

A key consideration is understanding the cost of error in each specific process. It’s important to note that even manual processes performed by humans do not guarantee error-free outcomes, and the human factor also carries its own risks. Artificial intelligence, in turn, provides an opportunity to reduce the likelihood of errors and improve the quality of task execution.

Let’s consider examples that highlight the importance of accurate decisions:

1. Automating email classification for task distribution among departments

— Sending a task to a wrong department has minimal consequences and can be rectified manually. In this case, it’s undoubtedly feasible to entrust this task to AI.

2. Extracting data from financial documents

— Incorrect extraction of amounts from an invoice can lead to significant financial losses. The cost of error is high, but the human factor also carries its risks. Can we reduce risks by entrusting this task to AI?

Solution: We should monitor the robots. To achieve this, it’s crucial to have three components in the system:

1. Post-processing rule configuration: This allows us to adjust the results of AI work. For instance, we might want to standardize extracted dates from receipts of different clients to a unified format.

2. Automatic validation rule configuration: How can we ensure that the final invoice amount is extracted correctly? We can set up a validation rule that sums the prices of all items in the invoice and compares the result with the final total.

3. Manual task execution environment: A space where a human can intervene to recheck and correct the results of artificial intelligence in case they fail validation.

4. Periodic model retraining based on manual correction results.

Solution: EasyRPA Platform

Fortunately, there are ready-made platforms that address these challenges, like EasyRPA. In addition to tackling the entire spectrum of tasks related to RPA automation, its key advantages in working with AI in the banking sector include:

- Integrated Machine Learning Models: EasyRPA provides the ability to train machine learning algorithms without coding and without requiring Data Science qualifications.

- Built-in OCR Models: Enables extraction and processing of data even from scanned documents.

- Flexible Configuration of Post-Processing and Validation Rules for AI Results: Allows fine-tuning rules for post-processing and validation of AI-generated results.

- Built-in Workspace Application: A dedicated space where human intervention can handle manual tasks and assist the AI.

- Continuous Model Retraining Based on Manual Corrections: The model is continually retrained based on the outcomes of manual corrections.

Attaining an optimal balance between automation and flexibility, and ensuring efficiency and security in banking business processes is possible only through a comprehensive approach where humans verify and enhance the work of robots.

Risk-Free RPA Pilot

How It Works

Selection: Together, we identify the most suitable process for automation, ensuring its significant enough to demonstrate true value.

Detailed Analysis: Our business analyst collaborates with you to craft a comprehensive description of the targeted process.

Budget Estimation: An IBA Delivery Manager reviews the project details, determining implementation costs and providing a transparent budgeting plan that accounts for all potential risks and out-of-scope tasks.

Agreement: Both parties align on a fixed scope of work to ensure clarity and mutual understanding.

Automation: Rely on IBA Group’s expertise to automate the chosen process seamlessly.

Zero Upfront Costs: As we operate on a post payment system according to the T&M model, you pay ONLY if you decide to deploy to production. If our robot is not a perfect fit, we will not charge for the work done

Zero License Costs: Once implemented, enjoy the automated process without any additional license fees.

Flexible Modifications: We believe in evolution, not reinvention. Minor process changes won’t be treated as brand-new projects. For significant alterations, we swiftly modify the existing code.

About the Risk-Free RPA Pilot

The Risk-Free Pilot isn’t just a showcase or a minimal product. It’s a comprehensive project, meticulously designed to offer genuine business value within your real operational environment. Move beyond traditional PoCs and MVPs, and experience the true potential of RPA with IBA Group 🚀.