Building a Digital Bank: AI, BPMN, IPA

Driven by innovation and digital transformation, modern banking is evolving at an unprecedented pace. The shift towards digital banking has revolutionized the industry, offering a broader spectrum of services compared to traditional banks that use outdated technology and strategies. In today’s landscape, the fusion of strategy and technology is imperative for success.

- From modern payment cores to advanced customer onboarding solutions, the digital era has expanded the horizons of banking services.

- Automated Know Your Customer(KYC) processes and internal business operations powered by Business Process Management (BPMN) and Artificial Intelligence (AI) are enhancing efficiency.

The integration of advanced AI technologies is paving the way for futuristic AI banking clerks, redefining customer interactions and operational excellence.

In this age of digital disruption, the synergy between strategic vision and cutting-edge technologies is reshaping the banking experience, propelling the industry towards a more innovative and customer-centric future.

AI Bank

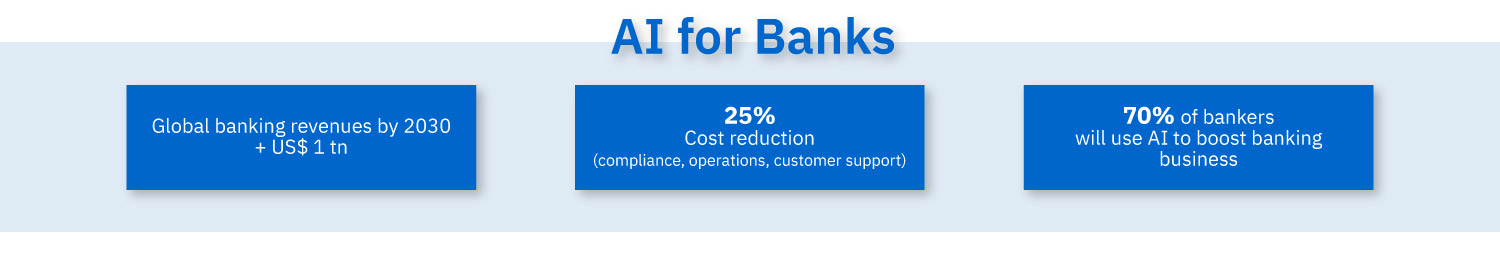

Leveraging AI, fintech companies and banks can

- Streamline operations

- Cut costs

- Diversify services

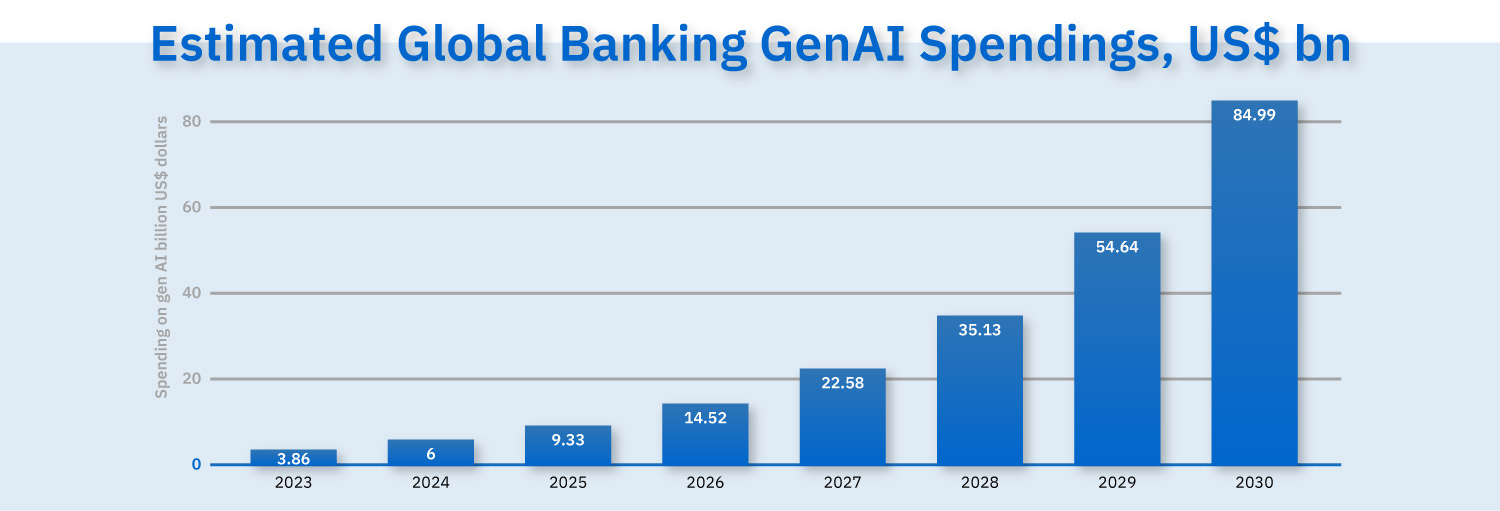

According to the McKinsey Global Institute, GenAI could contribute 2.8% to 4.7% of total industry revenues annually, primarily by boosting employee productivity through AI.

The global AI in the fintech market reached US$12 billion in 2023 and is projected to hit US$45 billion by 2032, with a compound annual growth rate of 15.5% from 2023 to 2032, as per CMI forecasts. Banks and fintech companies are increasingly seeking AI solutions for

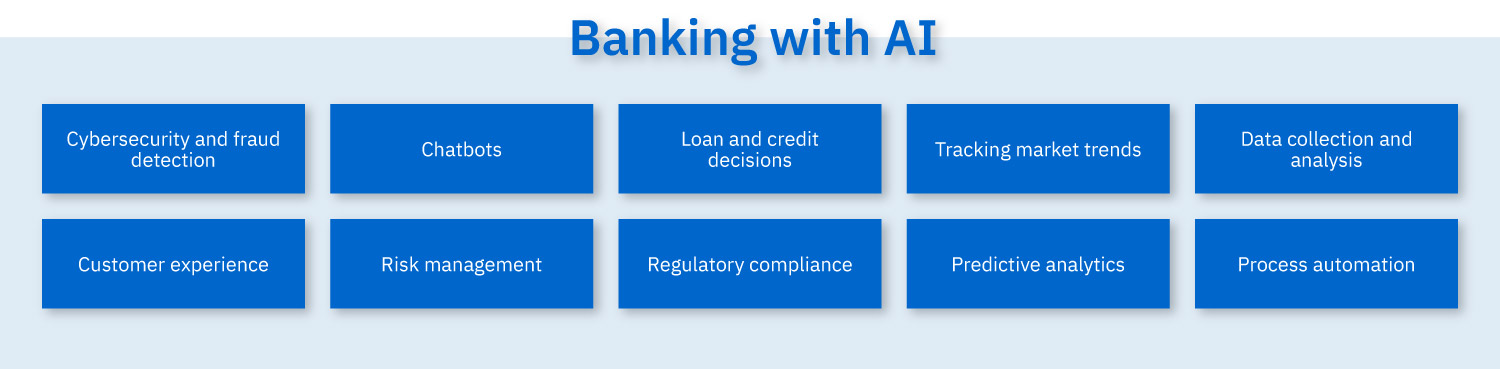

- Fraud prevention

- AI assistants

- Automated financial management

The potential of AI in fintech extends beyond current applications into the following fields.

- Asset valuation

- Personalized client services

- Automated loan analysis

- Risk reduction

Banking and AI

AI provides tailored recommendations for employees and companies, paving the way for enhanced decision-making and operational efficiency.

Business Process Modeling Notation (BPMN). The First Step to Build a Digital Bank

Banking operations are undergoing a significant transformation through the adoption of BPMN platforms that usher in a new era of automation and efficiency.

Leveraging BPMN platforms, banks can seamlessly transition to digital powerhouses, placing a strong emphasis on AI integration and operational excellence.

Key highlights of BPMN platforms in banking operations include

- Active operations such as investment activities, cash operations, and loans

- Passive operations that shape bank’s resources

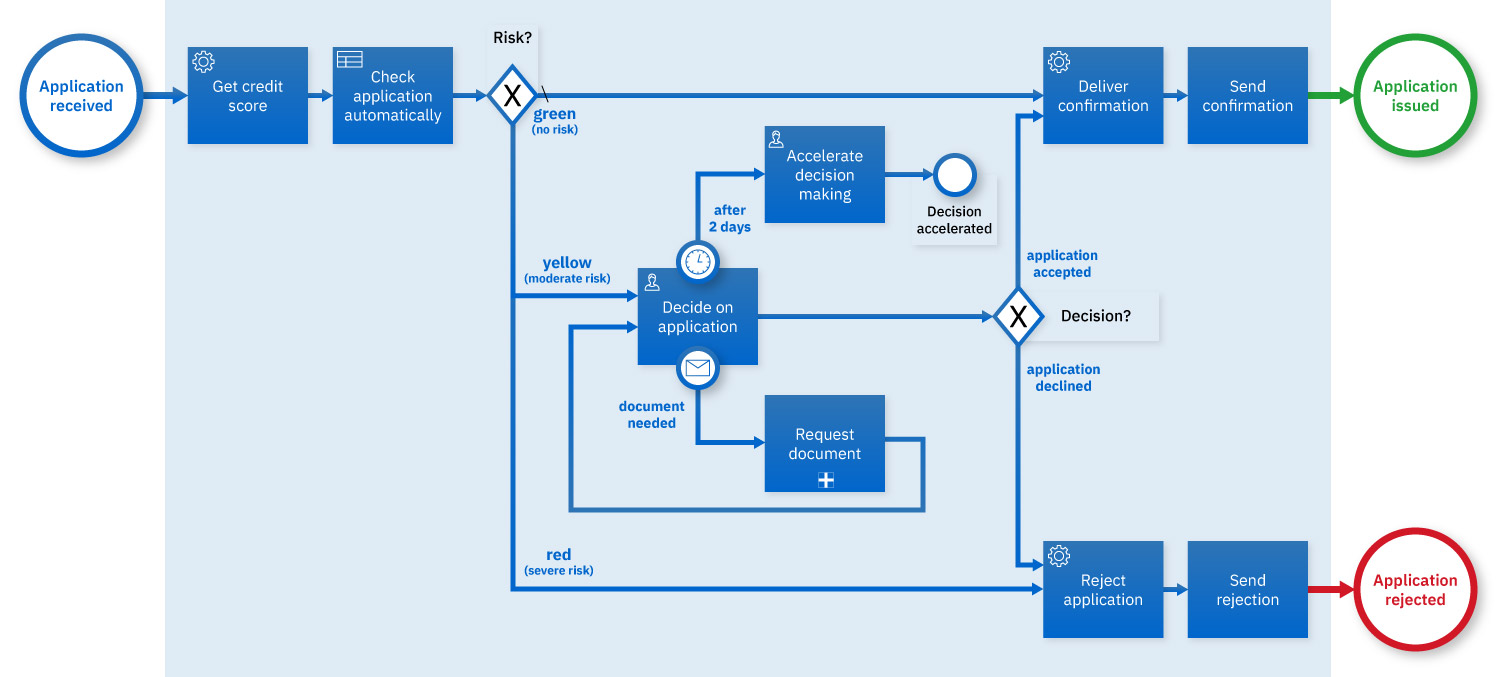

Loan Approval Process

These platforms encompass a diverse range of functions, including

- Loans and deposits

- Leasing and insurance

- Back office operations

- Procurement, and even

- Payment processing

BPMN and AI

With BPMN, banks can automate various processes that range from simple tasks to complex integrations. BPNM allows them to focus on defining processes, developing proofs of concepts, analyzing results, and selecting optimal automation options.

IPA for Banks

AI is reshaping modern digital banking, paving the way for innovative transformations in traditional banking practices. Using a blend of RPA and AI known as IPA, automation can revolutionize various banking segments, including

- Retail, corporate, and investment banking. Streamlining customer onboarding, support, marketing campaigns, and tracking

- Banking operations. Automating payments, verification processes, fee calculations, and other routine tasks

- Risk assessment. Simplifying customer information collection, financial monitoring, regulatory compliance, and collateral management

- Finance management and bookkeeping. Enhancing reporting, business closures, and day-to-day operations

- SW infrastructure. Implementing IPA for IAM, test management, and release procedures

- Procurement teams Leveraging automation for efficiency

This automation enables banks to streamline processes from customer onboarding to fraud detection, propelling them towards operational excellence.

IPA

Embracing BPMN, AI, and IPA is crucial for fintech sectors like regtechs, insurtechs, and neobanks, which are gaining traction due to their customer-centric approach.

Neobanks: Tech Giants

Neobanks stand out because of their advanced customer focus that has been helping them attract a growing customer base across generations. With digital banking becoming a global trend, the future holds promising opportunities for neobanks that witness significant adoption rates among Gen Z, Millennials, and Gen X.

- 20%+ of Gen Z uses neobanks (primary bank)

- 20%+ of Gen Millennials uses neobanks (primary bank)

- 20%+ of Gen X uses neobanks (primary bank)

The evolution of digital banks highlights the industry’s shift towards innovation and customer centricity.

- Sophisticated services

- Asset tokenization

- Personalized offerings (70%+ of consumers expect personalization)

- Embedded finances

Embracing a digital-first approach with AI and ML not only revolutionizes IT landscapes but also transforms business models, creating new revenue streams for the banking sector.

The future of banking lies in leveraging technology to enhance customer experiences and drive innovation. Keep banking!